The Corona-virus pandemic has triggered a huge amount of tax measures across the globe to help companies and citizens cope with the downside effects of the pandemic. In 2020 alone more than one thousand tax measures were implemented by authorities according to the OECD Country Tax Measures Database. The measures that we implemented can be categorized as follows, in order of increasing occurrence:

- Tax payment deferral

- Tax waiver

- Tax rate reduction

- Enhanced tax allowances or credits

- Tax filing extension

- Enhanced tax loss offset

- Accelerated tax refund

- More flexible tax debt repayment

- Increased benefits

- Enhanced benefit entitlement

- Tax increase

The vast majority of these tax measures have a temporary nature. In the figure below we see the end date of the various tax measures over time. We need to note here that a large number of these tax measures were stopped in December 2020, but at the same time a lot of new tax measures were instigated in the same month and in January 2021.

From the above graph we can see that in the second half of 2021 most of the existing tax measures will end. This might have significant implications for companies and citizens as companies will be asked to start paying deferred taxes and will lose access to credits or increased benefits. This will place a strong pressure on the cash flow position of companies.

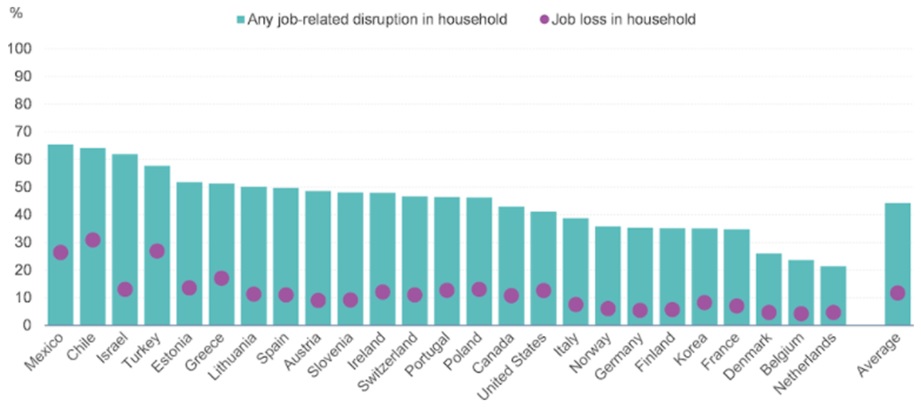

At the same time we see that employees have already suffered significantly across the globe. The OECD Risks That Matter Survey 2020 shows that over 10% of the households suffered from a job loss and almost half of the households experienced job-related disruptions, as we can see from the picture below.

The same study also shows that almost one-third of the households report financial difficulties since the start of the crisis. These are significant numbers that will have an effect on employee loyalty in the near future if not addressed properly.

If we bring the two observations together: companies potentially facing cash flow issues and employees experiencing financial difficulties – this might result in an increased amount of employees being on the look out for better paying positions in the near future. Some companies have asked the employees to sacrifice a part of their wage during the pandemic – these companies are double at risk, because the employees will expect to go back to their normal wages soon. If the company does not have the cash to do so, it might result in a lot of employees leaving the company.

For most countries, the additional tax relief measures to cope with the pandemic have caused significant discrepancies in the national budgets. These will have to be compensated for in the future, most likely by a higher tax pressure on companies and citizens. The good news here is that this might take several years, so the immediate effect will be minimal.

On the other hand, the potential cash flow effects foreseen for companies might have significant secondary effects. Customers might not be able to pay on time or even in full due to cash flow issues, this will enhance the existing cash flow issues for the company. Suppliers might not be able to deliver their raw materials in time or in full, which might cause disruptions in the manufacturing process and on time and in full delivery of finished goods to customers, which in turn will have a knock-on effect on cash flow issues.

All in all, it is important for company owners and CEO’s to prepare and have a clear view of various scenarios towards the (near) future, with a good view on the related risks and opportunities. It is paramount for companies to have a good insight in the wider supply chain risks and potential cash flow implications. At the same time, the strategic direction for the coming quarters must be clear and effectively communicated to all employees. It is a known fact that with insufficient information, employees are more prone to taking a negative view, hence good communication of a clear plan is crucial.

If you are looking for insights or help on topics like this, we invite you to schedule a free exploration call with us.